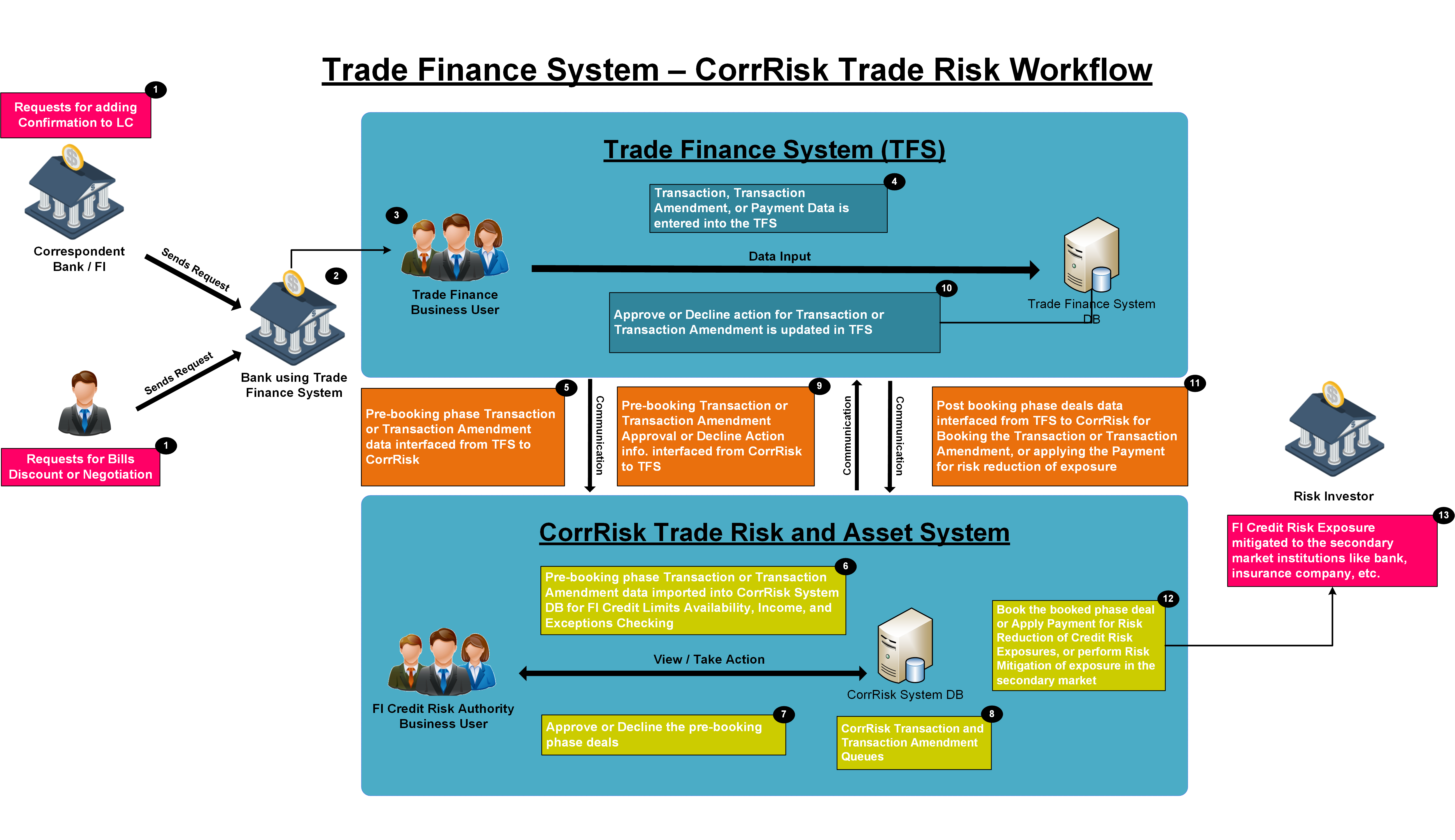

Integration of CorrRisk with the Trade Finance System

To increase the efficiency, accuracy, and to avoid the duplication of data input, the ‘CorrRisk Integration Module’ is designed and developed to integrate the CorrRisk solution with the Trade Finance Back Office System of the financial institution.

When used in tandem, Trade Finance Back Office System and CorrRisk offer the following joint benefits:

- Enterprise-wide trade risk consolidation and management that allows financial institutions to have an accurate view of their counterparty and country exposures.

- Automation and standardization of cross-group processes that improve efficiency, control and the overall turnaround time of the financial institutions’ trade finance business.

- Real-time limits monitoring and management of all trade transaction during their entire life cycle– including all pre-booking, booking, payment, amendments and/or risk mitigation phases that allows for optimizing the use of the financial institutions’ working capital.

- Robust and integrated Trade Asset management functionality which enables financial institutions to manage all of their secondary market activities.

- Enhanced decision-making through access to real-time and high quality data and reporting.